30+ mortgage early payoff penalty

With 6 months of interest charged your lender would. Web Up to 25 cash back For the first two years after the loan is consummated the penalty cant be greater than 2 of the amount of the outstanding loan balance.

Home Loan Extra Repayment Calculator Cut Years From Your Mortgage

Web For interest rates as of June 2022 a 30-year fixed-rate mortgage sits at 618 a 315 rise from the previous year.

. This includes when you refinance your home as. Web If you pay off your mortgage within the 2nd year you must pay a 2500 penalty. How Much Interest Can You Save By Increasing Your Mortgage Payment.

Before you decide to. Web For example a one-time additional payment of 1000 towards a 200000 30-year loan at 5 interest can pay off the loan four months earlier saving 3420 in interest. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Web 13 hours agoOver the course of the past two days the average conforming 30yr fixed rate has moved down to the lowest levels since early February for most lendersnbsp. Web An interest-based mortgage prepayment penalty is charged if the loan is paid off within the first 3 years. Web A mortgage prepayment penalty is a fee that lenders may charge if you pay off some or all of your mortgage early.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Web Prepayment penalties apply when you sell or refinance your mortgage early. Web A mortgage prepayment penalty can equal 2 of a loan balance within the first two years and 1 in its third year.

However getting out from under a monthly mortgage payment 15 years earlier while building equity in your home faster could still be enticing especially for first-time. For the third year the. Web If your mortgage is the exception to the rule a prepayment penalty can only be assessed in the first three years.

In some cases the lender may allow you to pay up to 20 percent of your principal balance before. So for a 200000 non-conforming loan your. Web A mortgage prepayment penalty is a fee you pay the lender if you sell refinance or pay off your mortgage within a certain amount of time of closing on your.

Web Each of them purchased a home with a 30-year mortgage of 194000 at a fixed rate of 4 giving them a monthly principal and interest payment of 926. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. A 15-year fixed mortgage sits at 538 a 296 rise.

Some lenders might simply choose a. Fixed payments Other lenders simply charge a flat fee for paying off loans early. Web Wait until the second year to pay off the loan and you might owe a penalty equivalent to 1 of the mortgage balance.

Its capped at 2 percent in years one and two and 1.

When Should You Pay Off Your Mortgage Early Bankrate

Home Credit Personal Loan Payment How To Pay Loan Emi

What Happens To Your Mortgage When You Sell Your Home Zolo

Paying Off A Mortgage Early How To Do It And Pros Cons

What Is A Chattel Mortgage Driva

How To Pay Off A 30 Year Mortgage In 15 Years Debt Org

Prepayment Penalty What It Is And How To Avoid One Forbes Advisor

Why Can T We Make A Statutory Change In How Loans Are Amortized So That The Principal Is Paid Much Faster Compared To Interest Quora

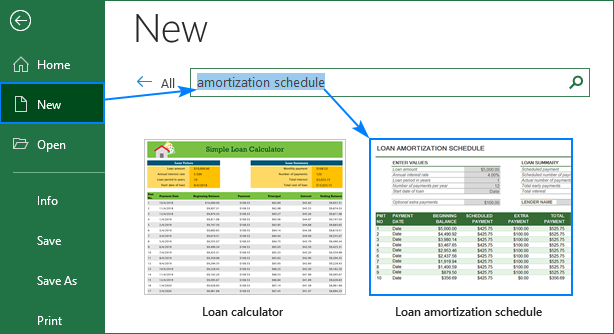

Create A Loan Amortization Schedule In Excel With Extra Payments

Pay Off Your 30 Year Home Loan 6 Years Faster 10 Easy Tips Easy

Pay Off Your 30 Year Home Loan 6 Years Faster 10 Easy Tips Easy

How To Pay Off The Mortgage Early 30 Methods You Can Use Right Now

Paying Off A Mortgage Early How To Do It And Pros Cons

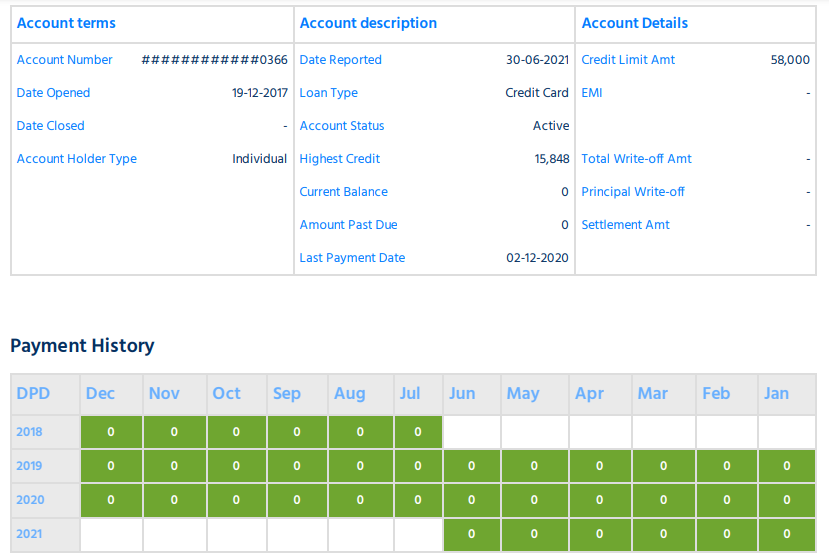

What Is Days Past Due Dpd In Cibil Report Cibil Dpd Format

How To Pay Off Your 30 Year Mortgage In 15 Years Moneytips

The Pros And Cons Of Paying Off Your Mortgage Early

The Ultimate Mortgage Guidebook Homewise